I will not share it all , this will have some things taken from the Meenaskhi Razdan (CA) to kepp things simple . But it take time for a company to be a blue chip and the truth is the that the mortality rate in the entrepreneurship and business is very high.

A blue chip share is a nationally recognized, well-established and financially sound company. These companies are old companies with reputed managements and well known for high standards of disclosure and corporate governance. They have a regular track record of profits and dividends. But the trick is to buy them cheap.

Though I am very nascent to the market and will be learning throughout my life from markets but all these latest markets has thought us(make us think)/ taught what it hadnt to the people/investors before us and I believe all their experience was laughed upon when they didnt know how to stay afloat in hard times. The times have become very complex and the so called well trained and experienced people are proving to be worthless ( they would be having various fancy degrees ).Jhunjhunwala says we are yet to see a bull market in India but I never felt a sustainable wide spread growth nature in India to have that run. But lets recourse our way towards the blue chips

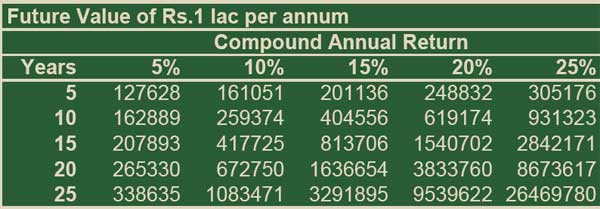

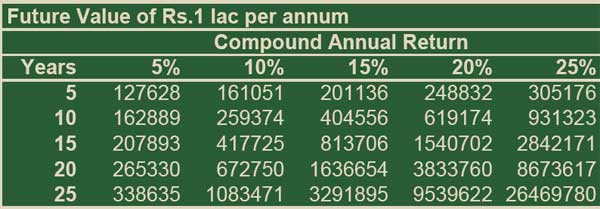

The common misconception amongst investors is that only unknown companies can become multibaggers because you can buy their share at low valuations as compared to the shares of well know companies which are always quoting at a premium. However, this is wrong. If a well known and established blue chip company is growing at 25% per year and the stock price keeps pace, a one-time investment grows 86 times. If you were to invest the same sum of one in annual intervals, your money would grow 429 times in 20 years!

Let’s take two practical examples to prove the point:

(i) An investment in one share of Nestle India on 1.1.2000 at the then CMP of Rs. 435 is worth Rs. 4500 today, giving a return of 895% (dividends extra);

(ii) An investment in one share of Asian Paints on 1.1.2000 at the then CMP of Rs. 158 is worth Rs. 3,700 today, giving a return of 2138% (dividends extra).

You can see how blue chips can turn into multibaggers by sheer passage of time.

The various Bluechips in India

Firstly, because, blue chip stocks are highly priced in relation to their earnings, it does not make sense to invest all funds in one go. It makes sense to accumulate these stocks by adopting a “Systematic Investment Plan” (SIP). Also, to avoid risk, the investor should buy a basket of 5 or 10 blue chip stocks.

Secondly, merely because a stock has the label of a “blue chip” does not automatically make it worthy of investment. An example is Bharati Airtel which may have reached the peak of its performance owing to intense competition in the market place. Another example is Infosys which appears to have little room to grow. As opposed to this, there are “evergreen” blue chips like Nestle which has a vast portfolio of products that it can release in India. HDFC is another example which enjoys near monopoly power in the mortgage finance market.

Several Mutual Funds have schemes dedicated to blue chip stocks. Among the popular ones are: SBI Blue Chip Fund

Principal Emerging Bluechip Fund

Franklin India Bluechip Fund

Mirae Asset Emerging Bluechip Fund

Indiabulls Blue Chip Fund

ICICI Prudential Focused Bluechip Equity Fund

ICICI Prudential US Bluechip Equity Fund

A blue chip share is a nationally recognized, well-established and financially sound company. These companies are old companies with reputed managements and well known for high standards of disclosure and corporate governance. They have a regular track record of profits and dividends. But the trick is to buy them cheap.

Though I am very nascent to the market and will be learning throughout my life from markets but all these latest markets has thought us(make us think)/ taught what it hadnt to the people/investors before us and I believe all their experience was laughed upon when they didnt know how to stay afloat in hard times. The times have become very complex and the so called well trained and experienced people are proving to be worthless ( they would be having various fancy degrees ).Jhunjhunwala says we are yet to see a bull market in India but I never felt a sustainable wide spread growth nature in India to have that run. But lets recourse our way towards the blue chips

The common misconception amongst investors is that only unknown companies can become multibaggers because you can buy their share at low valuations as compared to the shares of well know companies which are always quoting at a premium. However, this is wrong. If a well known and established blue chip company is growing at 25% per year and the stock price keeps pace, a one-time investment grows 86 times. If you were to invest the same sum of one in annual intervals, your money would grow 429 times in 20 years!

Let’s take two practical examples to prove the point:

(i) An investment in one share of Nestle India on 1.1.2000 at the then CMP of Rs. 435 is worth Rs. 4500 today, giving a return of 895% (dividends extra);

(ii) An investment in one share of Asian Paints on 1.1.2000 at the then CMP of Rs. 158 is worth Rs. 3,700 today, giving a return of 2138% (dividends extra).

You can see how blue chips can turn into multibaggers by sheer passage of time.

The various Bluechips in India

| Equity | Sector |

| ICICI Bank | Banking & Financial Services |

| Bharti Airtel | Telecommunication |

| Infosys | Information Technology |

| HDFC Bank | Banking & Financial Services |

| Grasim | Conglomerates |

| Reliance | Oil & Gas |

| ONGC | Oil & Gas |

| Kotak Mahindra | Banking & Financial Services |

| Dr Reddys Labs | Pharmaceuticals |

| IndusInd Bank | Banking & Financial Services |

| Axis Bank | Banking & Financial Services |

| Power Grid Corp | Utilities |

| Cadila Health | Pharmaceuticals |

| Bajaj Auto | Automotive |

| Coal India | Metals & Mining |

| NTPC | Utilities |

| Cummins | Engineering & Capital Goods |

| Cipla | Pharmaceuticals |

| GlaxoSmith Con | Food & Beverages |

| Hindalco | Metals & Mining |

| Mah and Mah | Automotive |

| GAIL | Oil & Gas |

| IOC | Oil & Gas |

| Idea Cellular | Telecommunication |

| Bharat Elec | Manufacturing |

| Yes Bank | Banking & Financial Services |

| Crompton Greave | Engineering & Capital Goods |

| Larsen | Engineering & Capital Goods |

| Oracle Financ | Information Technology |

| Dabur India | Consumer Non-durables |

| NHPC | Utilities |

| GlaxoSmithKline | Pharmaceuticals |

| Asian Paints | Chemicals |

| NMDC | Metals & Mining |

| SAIL | Metals & Mining |

| Union Bank | Banking & Financial Services |

| India Cements | Cement & Construction |

| Wipro | Information Technology |

| Torrent Power | Utilities |

| Nestle | Food & Beverages |

| Titan Ind | Miscellaneous |

Firstly, because, blue chip stocks are highly priced in relation to their earnings, it does not make sense to invest all funds in one go. It makes sense to accumulate these stocks by adopting a “Systematic Investment Plan” (SIP). Also, to avoid risk, the investor should buy a basket of 5 or 10 blue chip stocks.

Secondly, merely because a stock has the label of a “blue chip” does not automatically make it worthy of investment. An example is Bharati Airtel which may have reached the peak of its performance owing to intense competition in the market place. Another example is Infosys which appears to have little room to grow. As opposed to this, there are “evergreen” blue chips like Nestle which has a vast portfolio of products that it can release in India. HDFC is another example which enjoys near monopoly power in the mortgage finance market.

Several Mutual Funds have schemes dedicated to blue chip stocks. Among the popular ones are: SBI Blue Chip Fund

Principal Emerging Bluechip Fund

Franklin India Bluechip Fund

Mirae Asset Emerging Bluechip Fund

Indiabulls Blue Chip Fund

ICICI Prudential Focused Bluechip Equity Fund

ICICI Prudential US Bluechip Equity Fund